How KeyTurn Works

Engineering and architecture behind per-second MicroLiability

From vehicle telemetry to cloud-based actuarial processing

System Overview:

Precision from Ignition

to Policy

KeyTurn's infrastructure is a tightly integrated ecosystem designed for real-time data capture, secure processing, and dynamic policy management. It bridges the gap between vehicle telematics and traditional insurance systems, enabling granular, usage-based coverage.

The Core Data Flow

The journey of a MicroLiability policy begins and ends with precise data, flowing seamlessly through our custom-engineered components. This intricate data pipeline ensures that every second of vehicle operation is accurately captured and translated into policy status and charges, forming the bedrock of our per-second billing model.

OBD-II Device:

Ignition

Data

Capture

Secure Telemetry:

Data Transmission

Cloud Platform:

Real-time Processing & Rating

Mobile App:

Driver

Status

& Billing

Insurer APIs:

Policy

Integration

& Reporting

Component Breakdown:

Engineering for MicroLiability

Each element of the KeyTurn system is engineered for optimal performance, security, and interoperability, forming a robust foundation for per-second insurance. Our commitment to technical excellence ensures reliability and precision at every layer of the architecture.

KeyTurn OBD-II Device:

The Edge Node

Our custom-designed OBD-II device serves as the primary data acquisition unit, directly interfacing with the vehicle's Controller Area Network (CAN bus). It monitors ignition status (voltage changes on specific pins) with millisecond precision, ensuring accurate ON/OFF event detection. The device incorporates a low-power cellular module (e.g., LTE-M/NB-IoT) for secure, low-latency data transmission to the KeyTurn Cloud Platform. Integrated GPS provides location context for enhanced risk profiling, though not directly used for per-second billing. Advanced firmware includes anti-tamper mechanisms and cryptographic modules to protect data integrity and prevent unauthorized access or manipulation. Its robust hardware design ensures reliability across diverse vehicle makes and models, operating within automotive temperature and vibration standards. Power management features allow for minimal vehicle battery drain during idle periods, ensuring continuous operation without impacting vehicle performance. The device's compact form factor ensures discreet installation in most vehicle models.

KeyTurn Mobile Application:

Driver Interface & Control

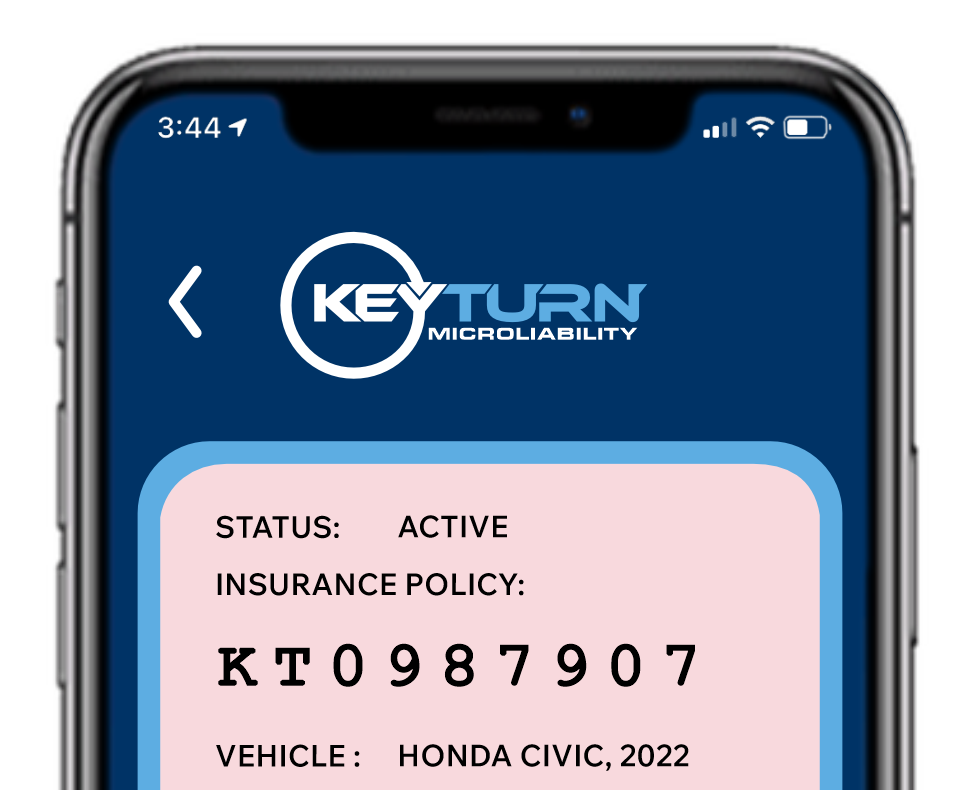

The mobile application (iOS/Android) provides the intuitive interface for the end-user. It connects to the OBD-II device via Bluetooth Low Energy (BLE) for initial pairing and local data synchronization, though primary telemetry is cellular-based. The app displays real-time policy status (active/inactive), driving statistics (duration, distance, estimated cost), and historical trip data. It serves as the digital proof of insurance, instantly verifiable. Push notification services alert drivers to policy changes, low balances, or critical events. Account management features allow users to update payment methods, view billing cycles, and access support. The app's architecture is designed for responsiveness and offline capabilities, ensuring a smooth user experience even with intermittent connectivity, and securely communicates with the Cloud Platform via RESTful APIs. This ensures drivers always have access to their policy information and control, enhancing transparency and user empowerment.

KeyTurn Cloud Platform:

The Central Intelligence

Built on a serverless, microservices architecture (e.g., AWS Lambda, Google Cloud Functions), the KeyTurn Cloud Platform ensures high scalability, fault tolerance, and cost efficiency. Data ingestion pipelines (e.g., Kafka/Pub/Sub) handle high-volume telemetry streams from devices. A real-time processing engine validates, enriches, and aggregates ignition data into billable seconds. The core rating engine, a proprietary actuarial module, applies dynamic pricing rules based on usage, time, and other risk factors. A dedicated billing and payment gateway automates micro-transactions. Insurer-facing APIs (RESTful/GraphQL) enable seamless integration for policy administration, claims data exchange, and regulatory reporting. Data lakes and warehouses (e.g., BigQuery, Redshift) store historical data for advanced analytics and machine learning applications, supporting continuous improvement of risk models and fraud detection algorithms. Role-based access control (RBAC) ensures secure multi-tenant operations for insurer partners, providing a comprehensive and secure data environment.

Data Flow & Real-time Processing

The integrity of per-second billing relies on a robust and secure data pipeline, ensuring every ignition event is accurately captured, processed, and translated into policy status and charges. Our system is designed for sub-second latency in critical operations, guaranteeing immediate coverage activation and precise billing.

Real-time Rating Engine:

Dynamic Pricing Actuarial Model

KeyTurn's proprietary rating engine is a sophisticated component of the Cloud Platform, representing a paradigm shift from traditional actuarial methodologies. Unlike conventional models that rely on aggregated historical data and static annual premiums, our engine processes real-time usage data (ignition ON/OFF duration, precise timestamps, time of day, day of week, and optional location context from GPS) to calculate premiums dynamically, down to the second. This allows for highly granular risk assessment and pricing, enabling insurers to offer truly competitive rates for low-usage periods and adjust for specific risk factors as they occur. The engine integrates seamlessly with insurer-defined rating tables and business rules, ensuring compliance with provincial regulations while maximizing flexibility for product customization. This dynamic pricing capability is a core differentiator, allowing for true pay-per-use models that benefit both drivers through fairer costs and insurers through optimized risk exposure and expanded market reach. The system can even incorporate future behavioral data for even more refined pricing.

Security & Regulatory

Compliance:

Built for Trust

Trust is paramount in financial services and data management. KeyTurn's architecture is designed with multi-layered security protocols and a deep understanding of regulatory requirements, ensuring data integrity, privacy, and operational legality from the ground up.

Robust Data Security

Architecture

All data transmitted from the OBD-II device to the cloud, and between the cloud and mobile app/insurer systems, is secured using industry-standard TLS 1.2+ encryption with strong cipher suites. Data at rest in our cloud storage is protected with AES-256 encryption, ensuring confidentiality and integrity. Our platform implements strict access controls (Role-Based Access Control - RBAC) at every layer, ensuring only authorized personnel and systems can access specific data sets based on their defined permissions. Regular vulnerability assessments, penetration testing by independent third parties, and continuous adherence to international security standards like ISO 27001 and NIST frameworks form the backbone of our security posture, safeguarding sensitive driver and policy information against evolving cyber threats and unauthorized access.

Provincial Regulatory

Adherence & Auditability

KeyTurn's system is meticulously designed to comply with Canada's fragmented provincial insurance regulations. This includes adherence to specific requirements for third-party liability policy binding, rating, and settlement across provinces like Ontario (FSRA) and Alberta (AIRB). Our platform facilitates automated generation of provincially compliant documentation and granular reporting, essential for regulatory audits. Furthermore, our data handling practices strictly adhere to privacy laws such as PIPEDA (Personal Information Protection and Electronic Documents Act), ensuring transparent consent mechanisms, data minimization principles, and secure data anonymization where applicable. This built-in compliance and auditability reduce the regulatory burden for our insurer partners, allowing them to confidently offer MicroLiability products with full legal assurance.

Seamless Insurer Integration:

Enabling the Ecosystem

KeyTurn is designed as an enabling technology, not a replacement. Our robust API suite and flexible integration options ensure a smooth, secure connection with existing insurer core systems, minimizing disruption and accelerating time-to-market for MicroLiability products. This collaborative approach fosters an efficient and interconnected insurance ecosystem.

API & Data

Exchange Protocols

Our Cloud Platform exposes a comprehensive suite of well-documented APIs, primarily RESTful, with optional GraphQL endpoints for more complex query needs. These APIs enable seamless, real-time data exchange, allowing insurers to: 1) Programmatically onboard new drivers and provision OBD-II devices, 2) Receive immediate policy status updates (e.g., coverage activation/deactivation notifications), 3) Access aggregated billing data for reconciliation and invoicing, and 4) Integrate granular usage data into their existing claims processing, actuarial, and CRM systems. Data formats are standardized (e.g., JSON) and adhere to industry best practices. Secure API keys, OAuth 2.0 protocols, and IP whitelisting ensure authenticated and authorized access to all endpoints, maintaining data integrity and confidentiality during exchange.

Accelerated Time-to-Market

& Scalability

By providing a complete, ready-to-deploy infrastructure for per-second MicroLiability, KeyTurn drastically reduces the time and investment required for insurers to launch new usage-based products. Instead of years of internal R&D, custom hardware development, and platform build-out, insurers can leverage KeyTurn's proven, pre-certified technology stack. Our dedicated integration support team works closely with partners, offering comprehensive API documentation, SDKs, and technical assistance from initial sandbox testing to full production deployment. This allows insurers to quickly capture new market segments and respond to evolving consumer demands without significant upfront capital expenditure or prolonged operational risk, enabling rapid innovation and competitive advantage.